Create a Monthly Budget & Measure Your Annual Financial Performance

Context

One of the most important steps that anyone can take to understanding their own financial situation is to create a budget. This helps spenders understand how much money is coming in, how much is going out, and how much they are retaining to enable them to shape their behavior to achieve their financial goals.

Steps to Create Your Budget

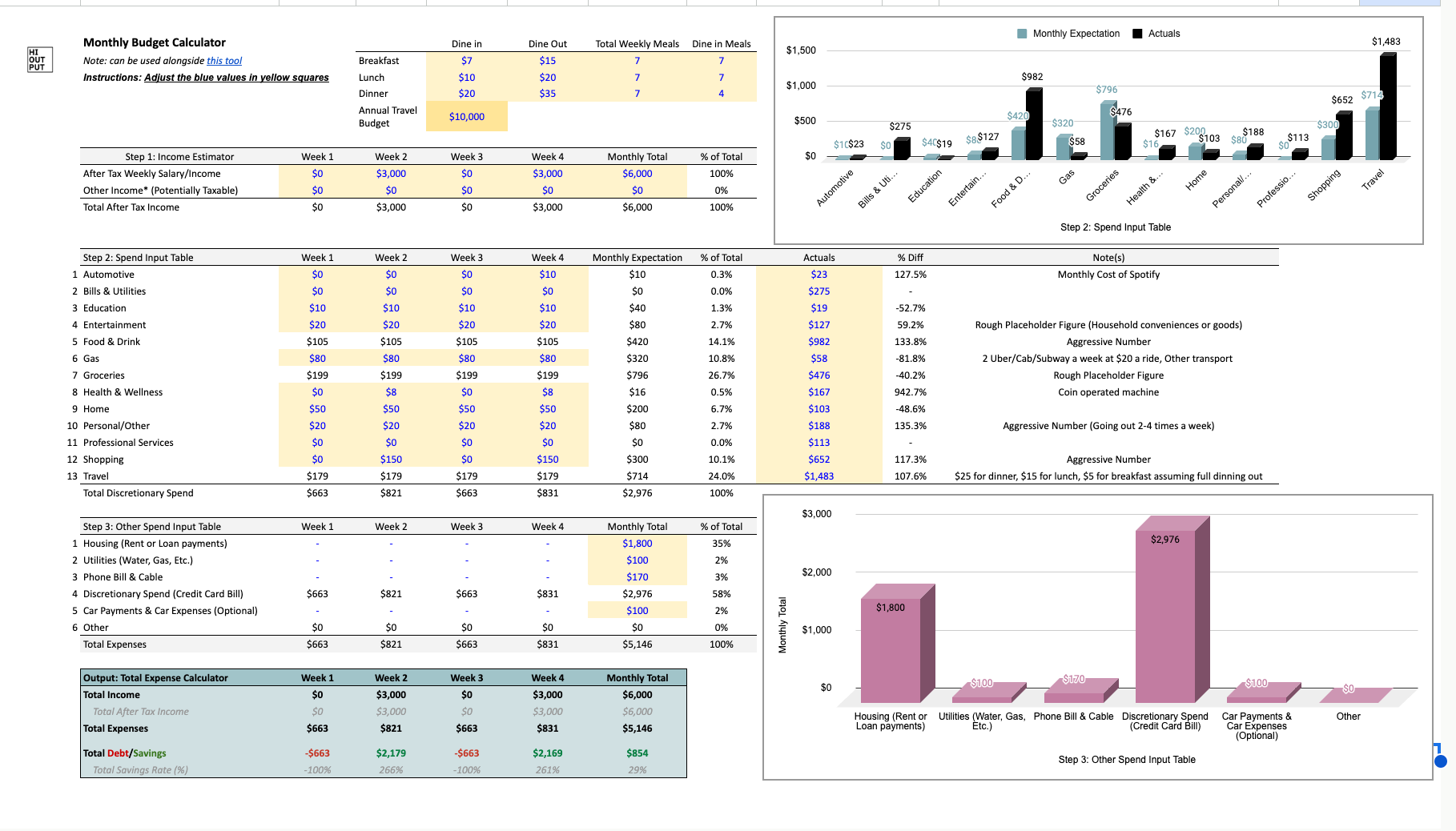

- Fill in your expected Monthly Income and any other post tax income.

- Calculate how much you think you spend in a given month on each of their discretionary spend categories (or use actuals if available). This helps consumers juxtapose their actual spend vs. their expectations. We utilize a comparison against actual column to help users fine tune their spend expectations in reality.

- Fill in all of the more regular non-discretionary spend like housing, car payments etc. that are more regular fixed payments.

Strategies to Evaluate Your Performance

-

Compare Your Expected and Modeled Spend to Actual Credit Card Spend: this will help you determine if the reality of your spend and your expectations are aligned. Taking this step can also put your spend into perspective or help highlight where you were overly optimistic.

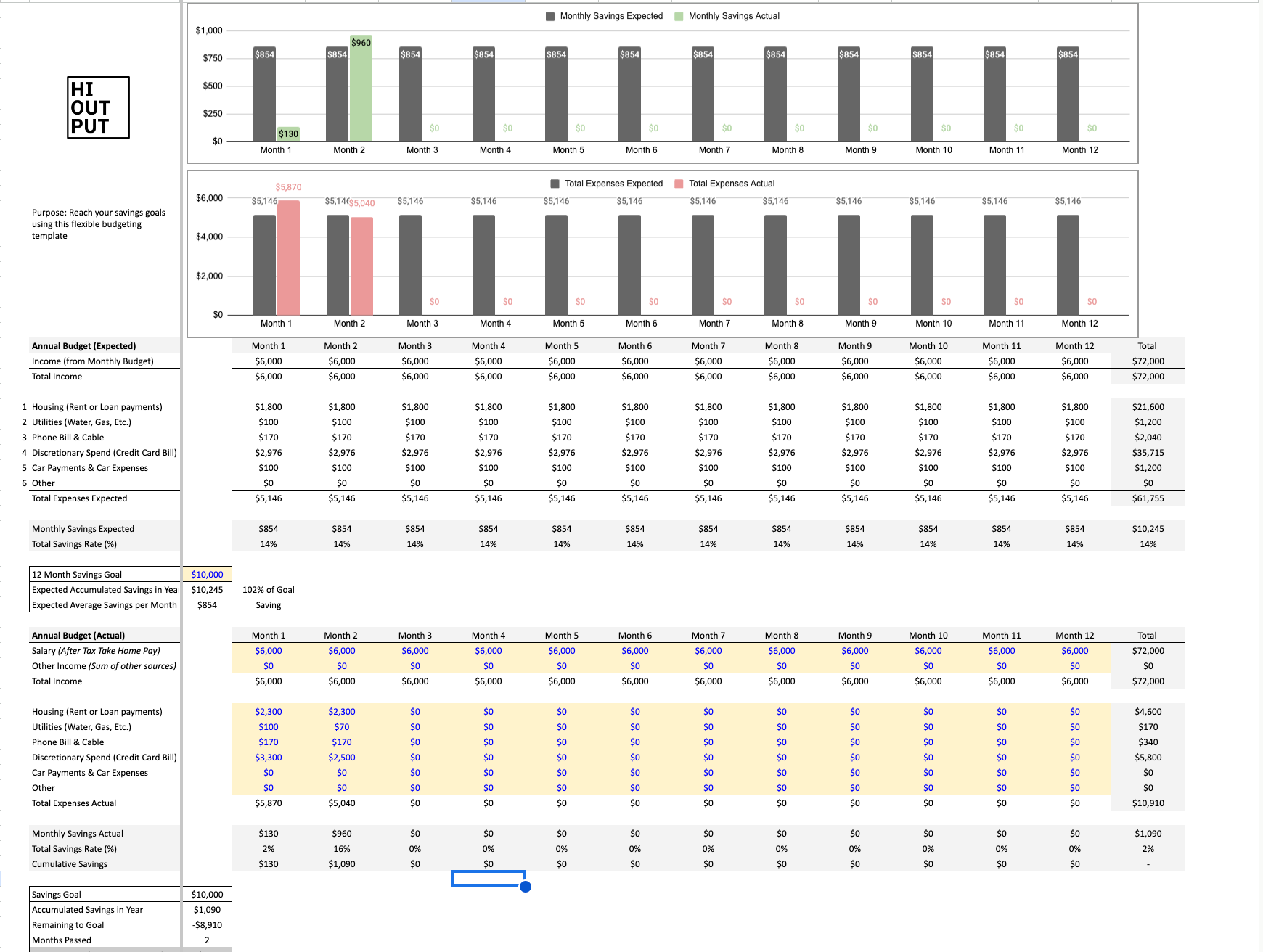

- Establish a 12 month Savings Goal and Understand the Implications of Achieving It: an aggressive goal means that you will likely have to save aggressively to achieve, modify your behavior accordingly.

- Track your Actual Performance Against Expectations Each Month: The only way you know if you are in line with your expectations is tracking what you spend monthly, ensure that you are increasing your savings in months after you fall behind your savings goals or relaxing if you find yourself ahead.

Conclusion

This two in one template gives users an easy to use financial guide to track and evaluate their annual spend. Collectively with regular updates to log actual spend and income users can expect to confidently understand where they are relative to their savings goals, where they are going astray, and what they need to do to achieve their goals.

Note(s):

- Leaving out a singular big spend items in your budget can also give you a sense for how much rent or car you can afford assuming all else equal. This can help ground your purchasing decision assuming all else is equal.

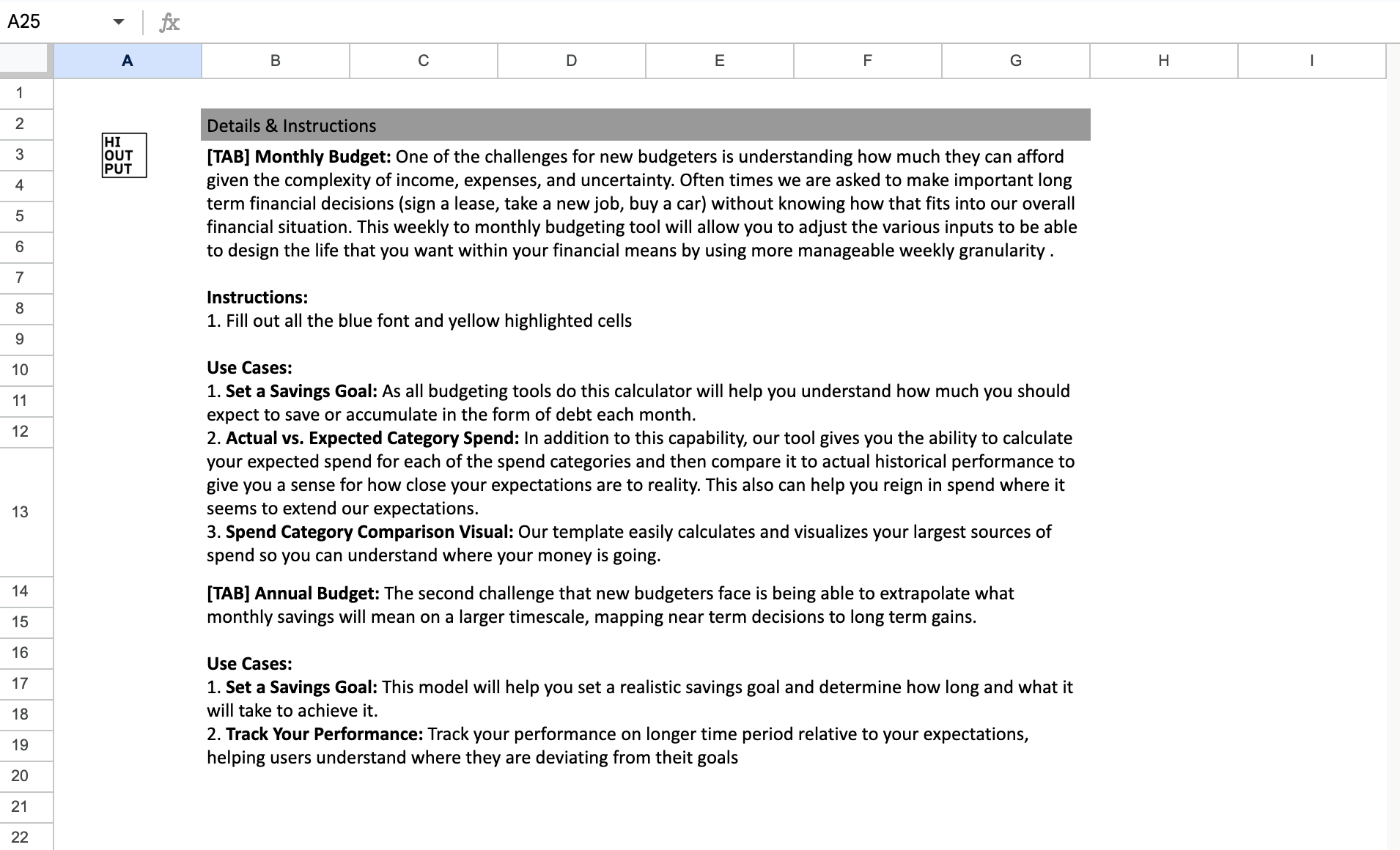

- After downloading this product you will receive an email with a url and QR code to access this financial tool. Simply enter the URL into the browser and make a copy of the sheet to use for your own purposes. Instructions on how to use the spreadsheet can be found within the spreadsheet itself.