Calculate your Net Worth

Context

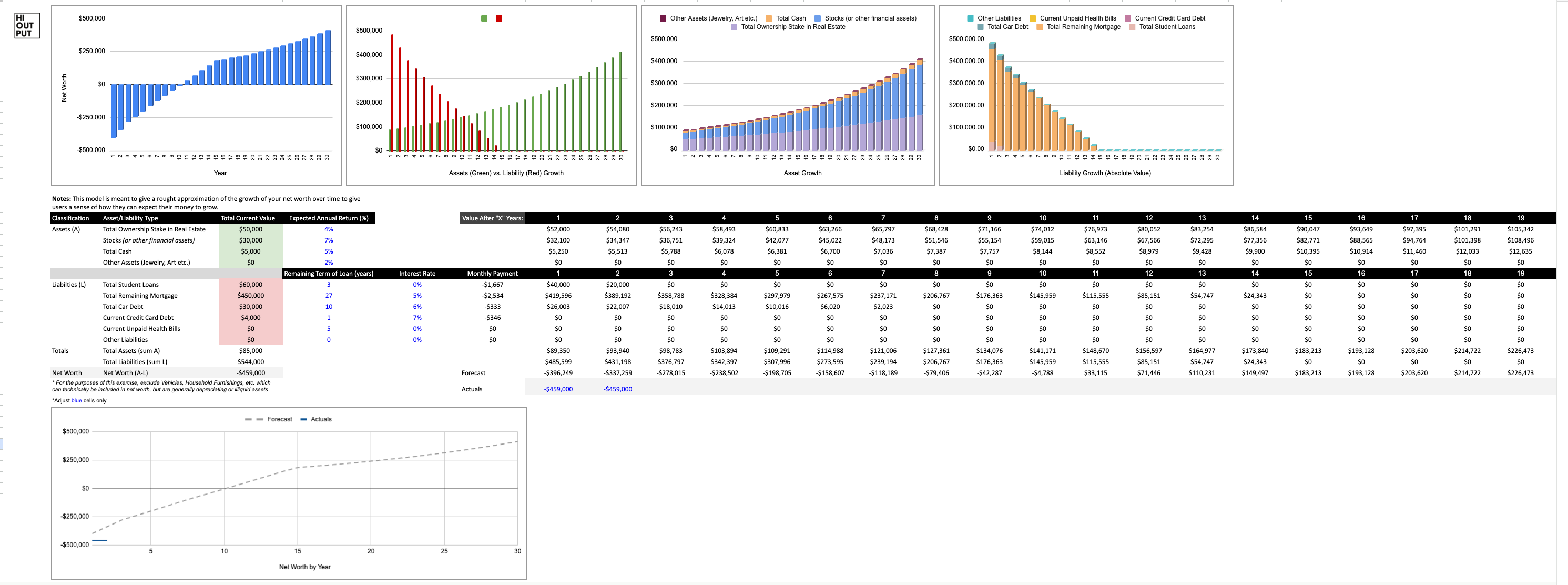

The most important number to measure for your financial well being is net worth and many people don't know how to quantify it. With this simple Google Sheet Net Worth calculator we use a few different strategies to help consumers learn more about and understand this important financial measure.

Strategies to Measure Your Net Worth

- Calculating and tracking your net worth over time is the fundamental first step in our strategy. Using the Actual Net Worth tab, enter in the current value of various asset classes for you and a partner and copy and paste these values into the historical table each time you want to update your net worth. This will not only help you measure your net worth but also track it over time.

- Our second strategy is forecasting net worth over the course of a year (our Expected Short Term Net Worth tab) and over the course of 30 years (our Expected 30 Year Net Worth Tab). These two tabs can give a clear idea of how your assets and liabilities will grow and change in the short and long term. With this users can understand how paying off debt can accelerate net worth growth or how asset return impacts the same metric.

- The last strategy that we use to Measure Your Net Worth is an Actual vs Forecasted tracker found in both the Monthly and 30 year forecasting tabs. These two charts will help you understand how you are tracking relative to forecast and how you should expect these values to change over time. Understanding how you are tracking can help you determine if you need to change your tactics.

Conclusion

Ready to figure out your net worth? Tired of using overly complicated software and ad infested sites. This is a simple and flexible google sheet template for calculating a snap shot of your net worth and forecasting its expected growth into the future, giving users a great foundation to elevate their finances. Struggling with the spreadsheet reach out to us ops@hioutputblog.com for help.

Note(s):

- This version of the model does not take into account additional future monetary contributions to asset classes, it is simply meant to show how you can expect your current assets and cash to grow over time. This is useful because it makes no assumption of your future behavior or circumstances (a topic we will cover in a subsequent model), allowing us to understand the impact of compounded interest and debt repayment on our financial position.

- After downloading this product you will receive an email with a url and QR code to access this financial tool. Simply enter the URL into the browser and make a copy of the sheet to use for your own purposes. Instructions on how to use the spreadsheet can be found within the spreadsheet itself.