Find the Best Rewards Card

Context

In this template, we allow you to compare three years of data for multiple credit cards to determine which one is best. Avoid misleading marketing and use real data to inform your decision. We use the following strategies to help purchasers differentiate between various card options.

Strategies to Identify the Best Credit Cards

We use three different strategies and associated tabs to help inform consumers.

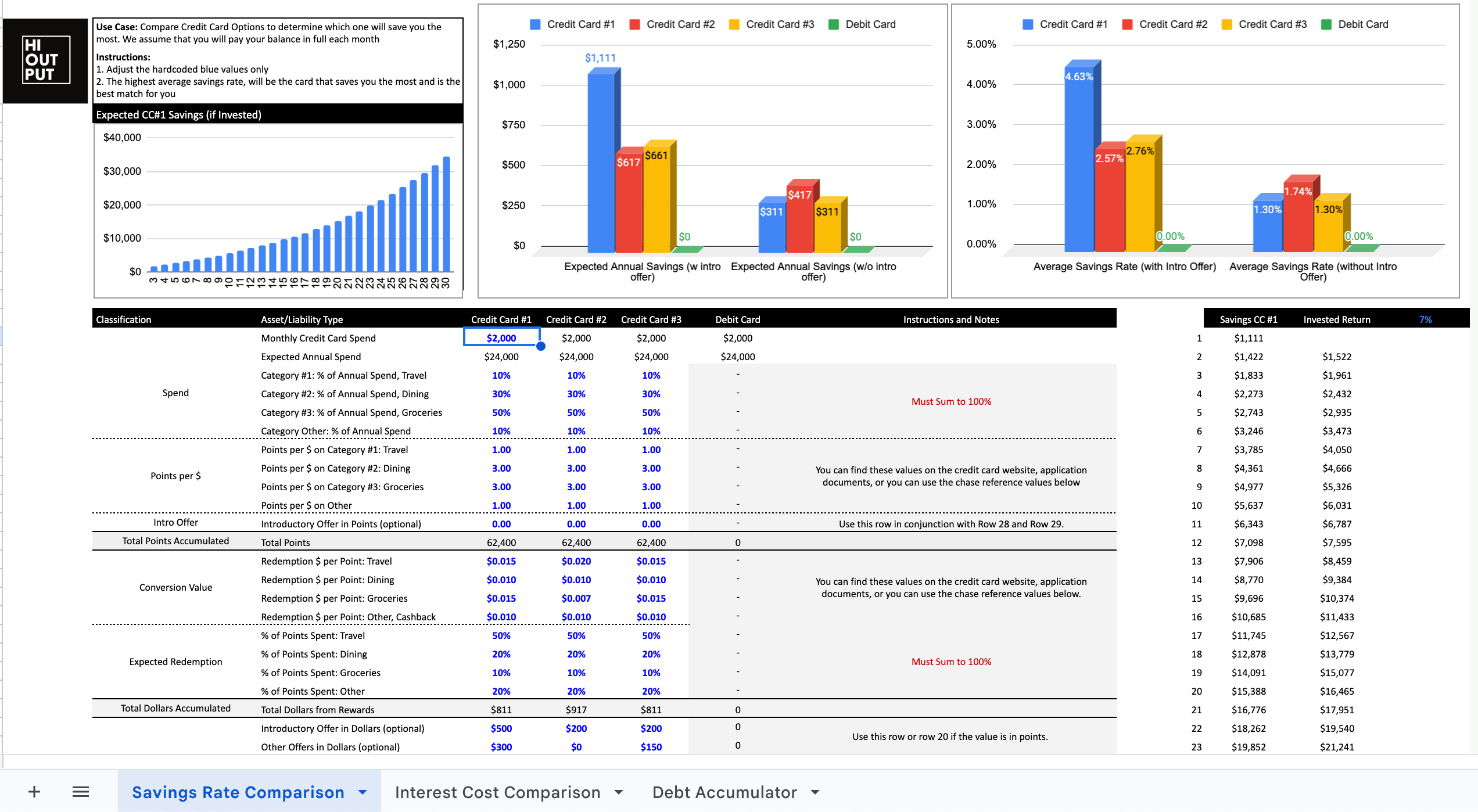

- One of the most compelling reasons individuals choose credit cards is the ability to generate cashback and rewards. Using the Savings Rate Comparison tab we allow users to compare up to three credit cards with varying rewards structures to determine which card will save them the most money. In addition we also include a 30 year forecaster to show much these savings if invested could turn into. In combination, this tab should give users a clear idea if a card is right for them and how it compares to a debit card.

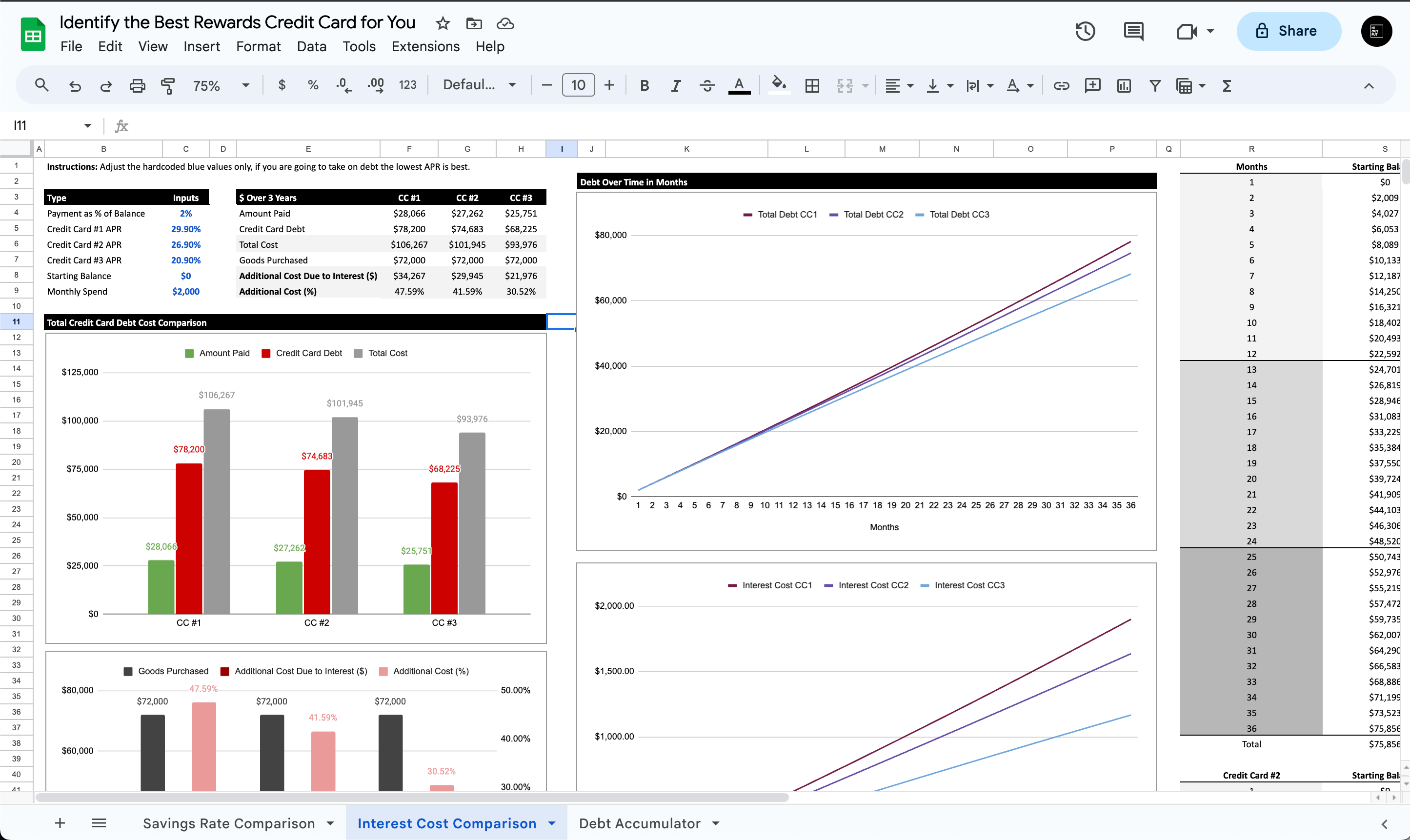

- While it is important that credit card users try to avoid accumulating a meaningful credit card balance, we acknowledge that for those that do or have to comparing the differing APY's and there impact on interest over time is also a useful dimension to consider. In the Interest Cost Comparison tab we visualize the costs associated with varying APY's given a consistent spend level, giving users a good idea of how varying APY's can impact their given situation.

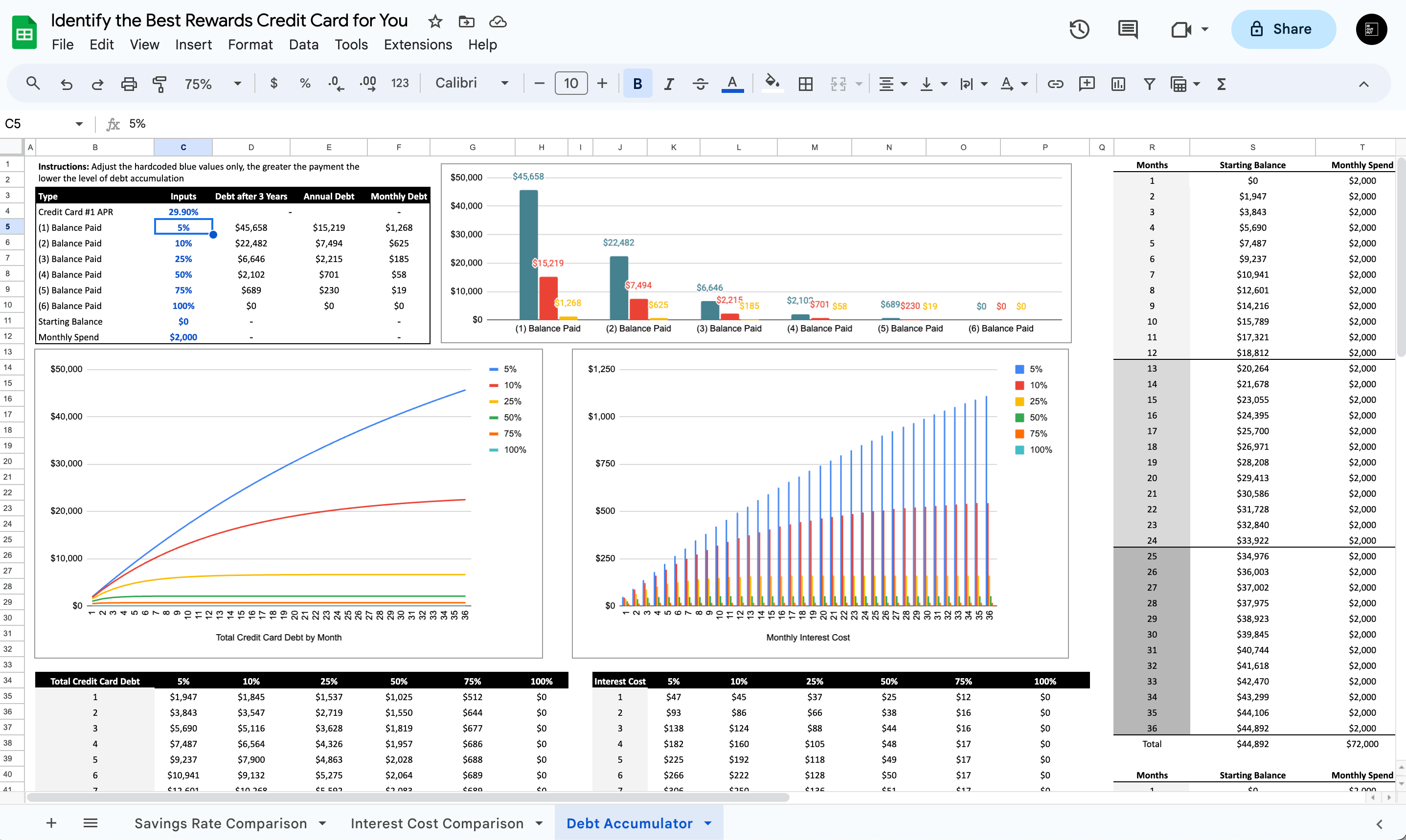

- Collectively the two prior strategies should be sufficient in evaluating which card is best, however, for those new to credit cards we added the Debt Accumulator tab to help users understand how the amount of their balance that they pay directly impacts the accumulation of credit card debt.

Conclusion

Once users are able to collect the APYs, Point Multipliers, Redemption Value of their Points for the cards under consideration this model will provide a clear understanding of which credit cards generate the most savings and the relative impact of different APYs on debt if the need to take out a loan arises.

Find the Best Rewards Card

Sale price$1.00 USD

Regular price$5.00 USD (/)