Analyze Your Credit Card Bill

Context

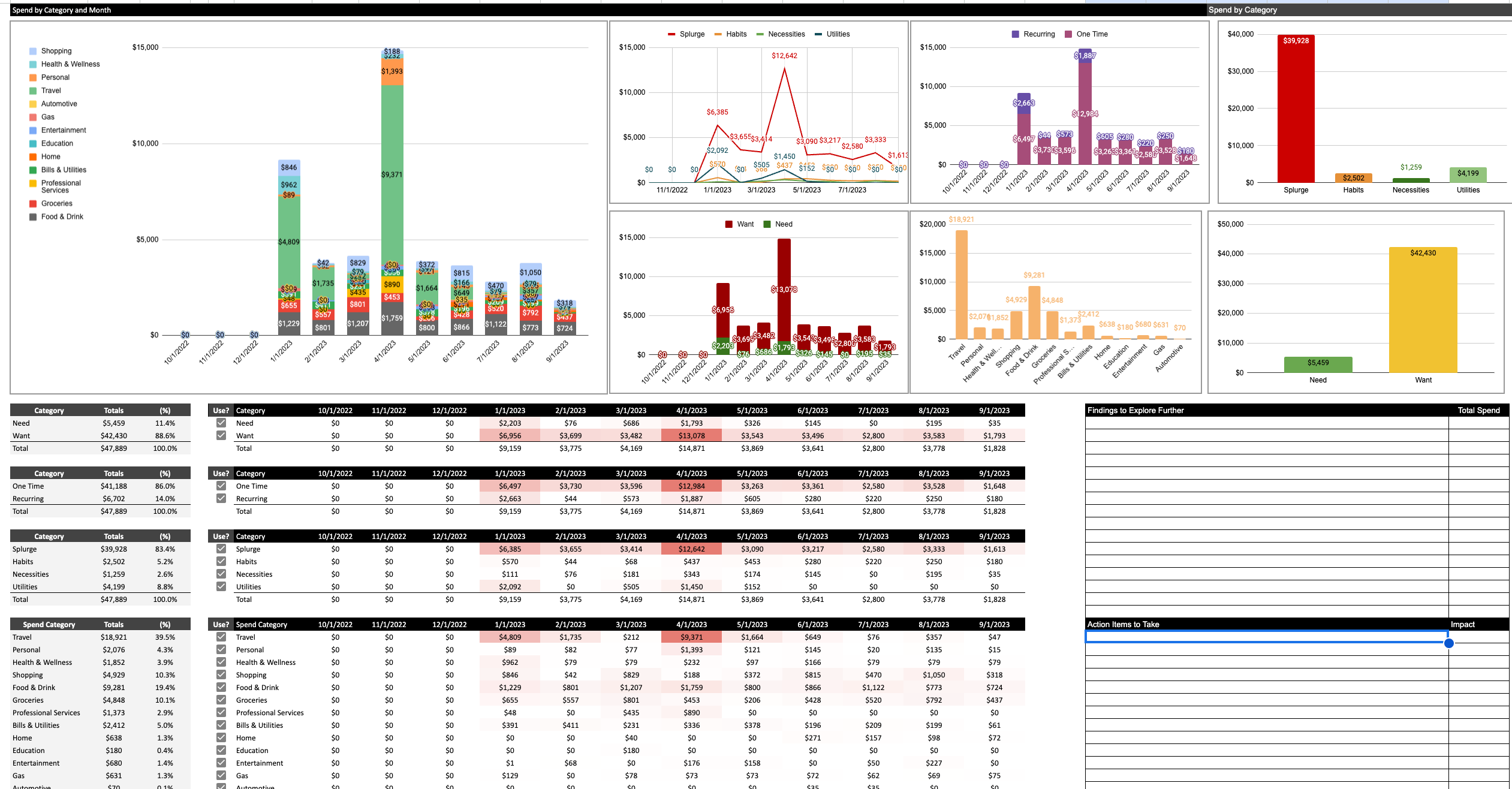

This highly flexible and automated credit card expense tracker visualizes up to a year of credit card expenses to enable users to identify forgotten subscriptions, problematic spending behavior, sneaky card fees, and months of overspend. We are able to do this using a flexible Google Sheet that deploys four distinct strategies:

Strategies to Reduce Credit Card Spending

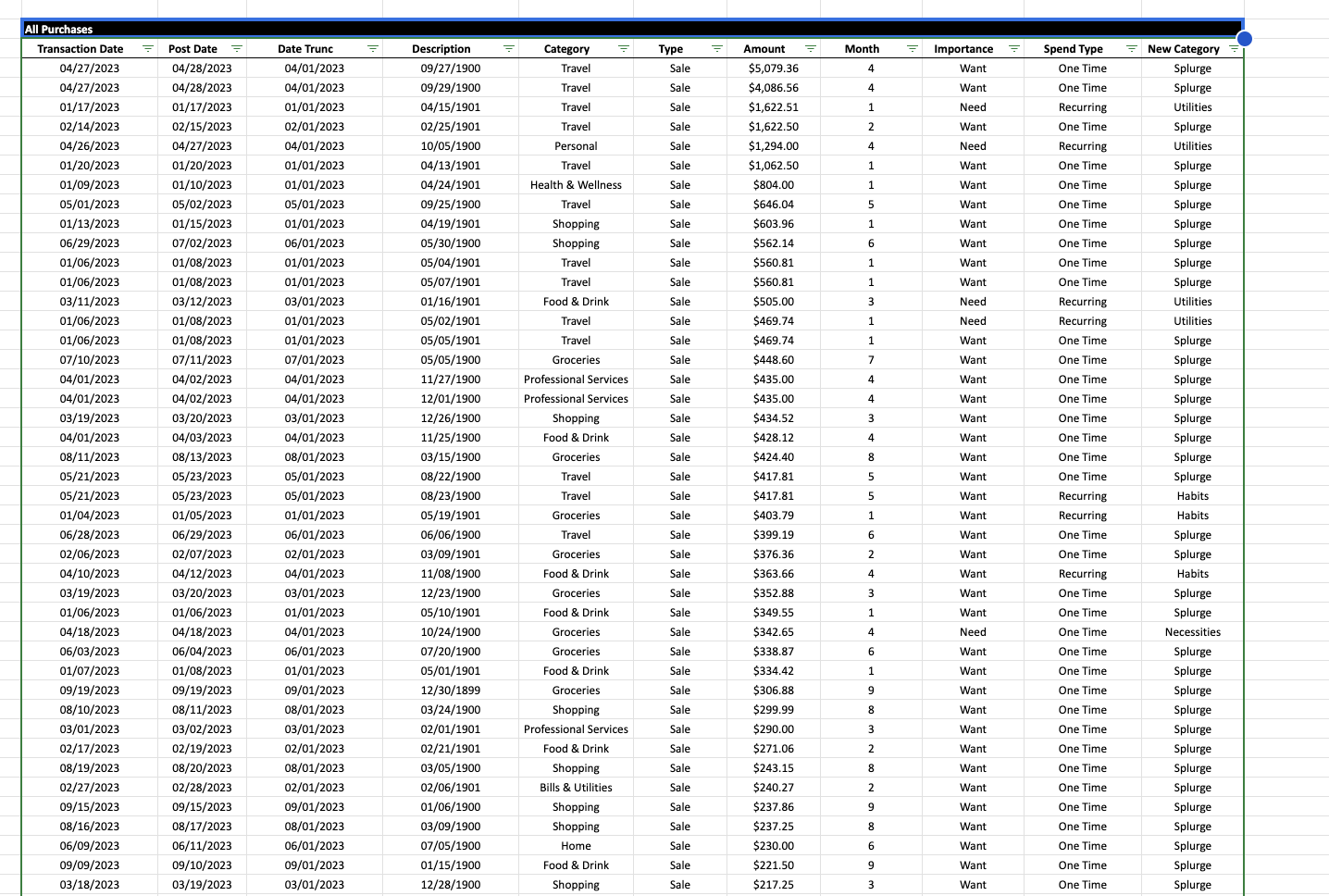

This Google Sheet tool requires users to download import their Chase Credit Card Activity CSV or a similarly formatted data set, once complete the tool automatically does the following

- Categorize your Expenses into Needs, Wants, Recurring, and One Time Expenses via the Helper Tab to identify what spend is necessary and what is nice to have and what is a recurring purchases vs. a one off selection.

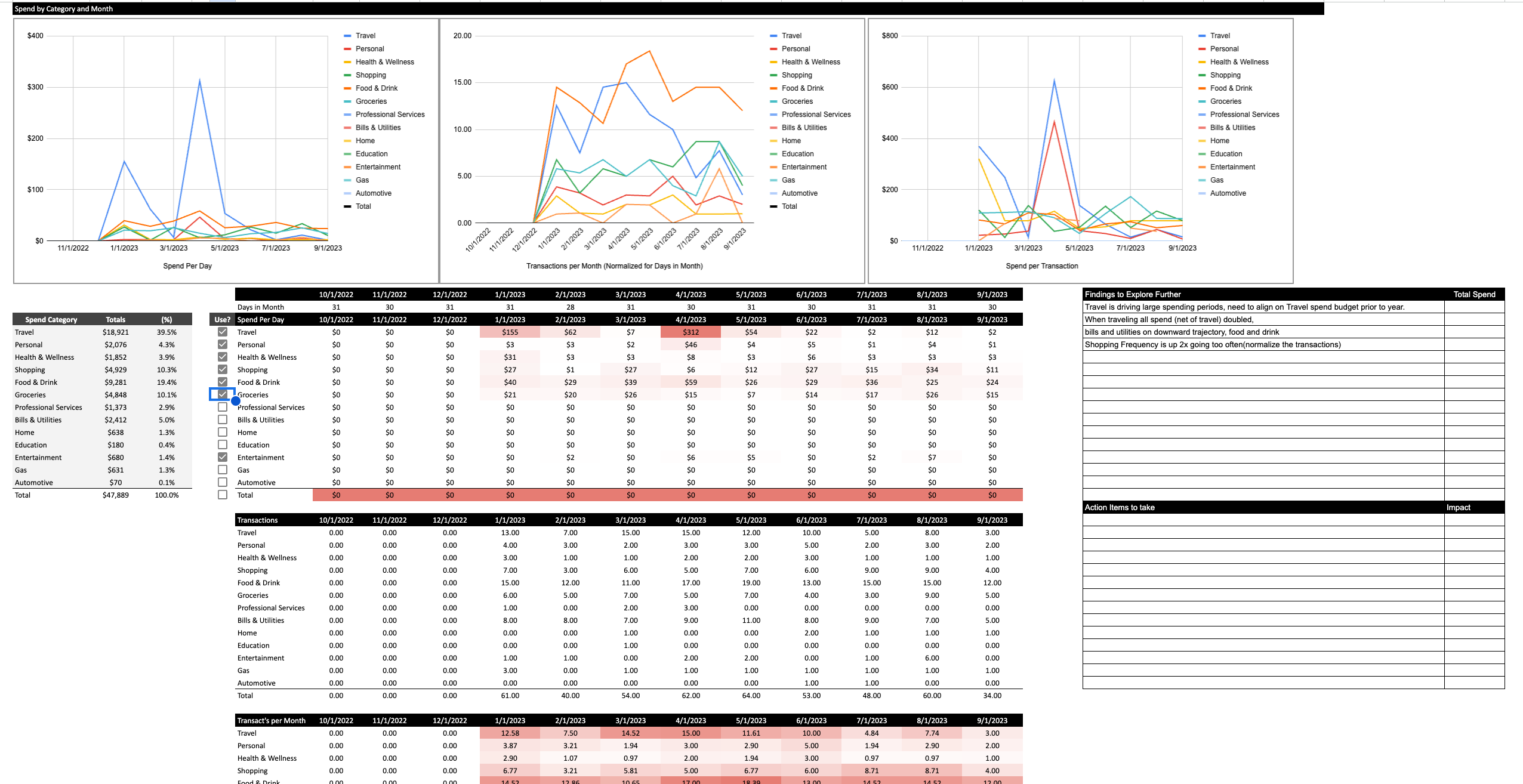

- Visualize and Identify the months and categories that are driving your spend via the Purchase Analyzer. Use the check boxes in the sheet to visualize and calculate on the fields that you want for dynamic and useful spend categories.

- One of the most important determinants of your overall spend is the frequency and the per transaction costs associated with your monthly expenditures, in the Spend Trends tab we can clearly see whether frequency or "big ticket" items are causing your spend to rise or fall. Curious to know if your plan to cut down on your coffee habit is paying off, check to see if your Food & Drink transactions are falling.

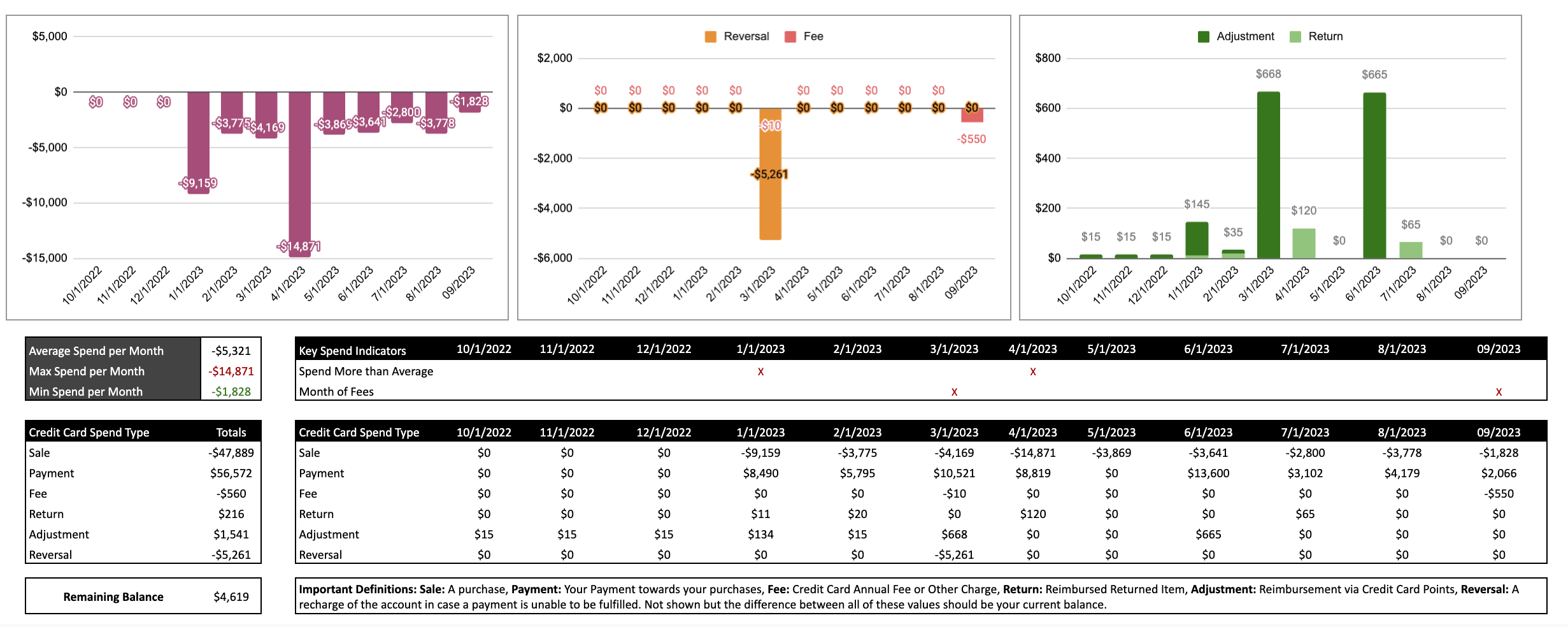

- The frustrating thing about fees today is that credit cards hide these expenses in random months over the course of the year. The Card Cost tab helps to identify when those fees occur so you can be aware of their timing and amount.

- The last tab is the Purchase Review tab which when used in conjunction with the other tabs can pinpoint the actual transactions that are driving up your credit card spend whether you are currently aware of them or not.

Conclusion

This flexible expense tracker is a worth-while companion to do a deep dive on the last 12 months of your credit card spend. This template unlocked hundreds of dollars in savings for its creator, who designed it to figure out where their money was going each month. Specifically built for Chase credit card users but applicable for any similarly formatted CSV file, this tool can be used to find hundreds of dollars in opportunities to reduce your credit card spend.

Note for Non-Chase Credit Card Users: In order to format the CSV properly, simply download 12 months of Credit Card activity from your credit card provider and make sure that the CSV file columns are lined up with the pre-seeded data in Tab 2 and that the value (+/-) of the amounts are similarly formatted. Other differences should be handled by the spreadsheet. If you have any conversion issues, reach out to ops@hioutputblog.com for time with one of our experts.