Blog #4 in the series on wealth accumulation, Context: Male, 29 years old, six figure net worth

One of the incredible things about our society today is that even though we are highly capitalistic a large portion of our society struggles to save. Ignoring the societal factors, of which there are many, there are also very few practical resources for average Americans. Financial advisors provide a potential solution but many of us are led to believe the strategies are inaccessible, get trapped in opaque and unnecessarily complicated financial "solutions", or don't have the fundamental understanding to have an informed conversation. In this blog, we will cover financial freedom checklist that I am using to guide my own financial development:

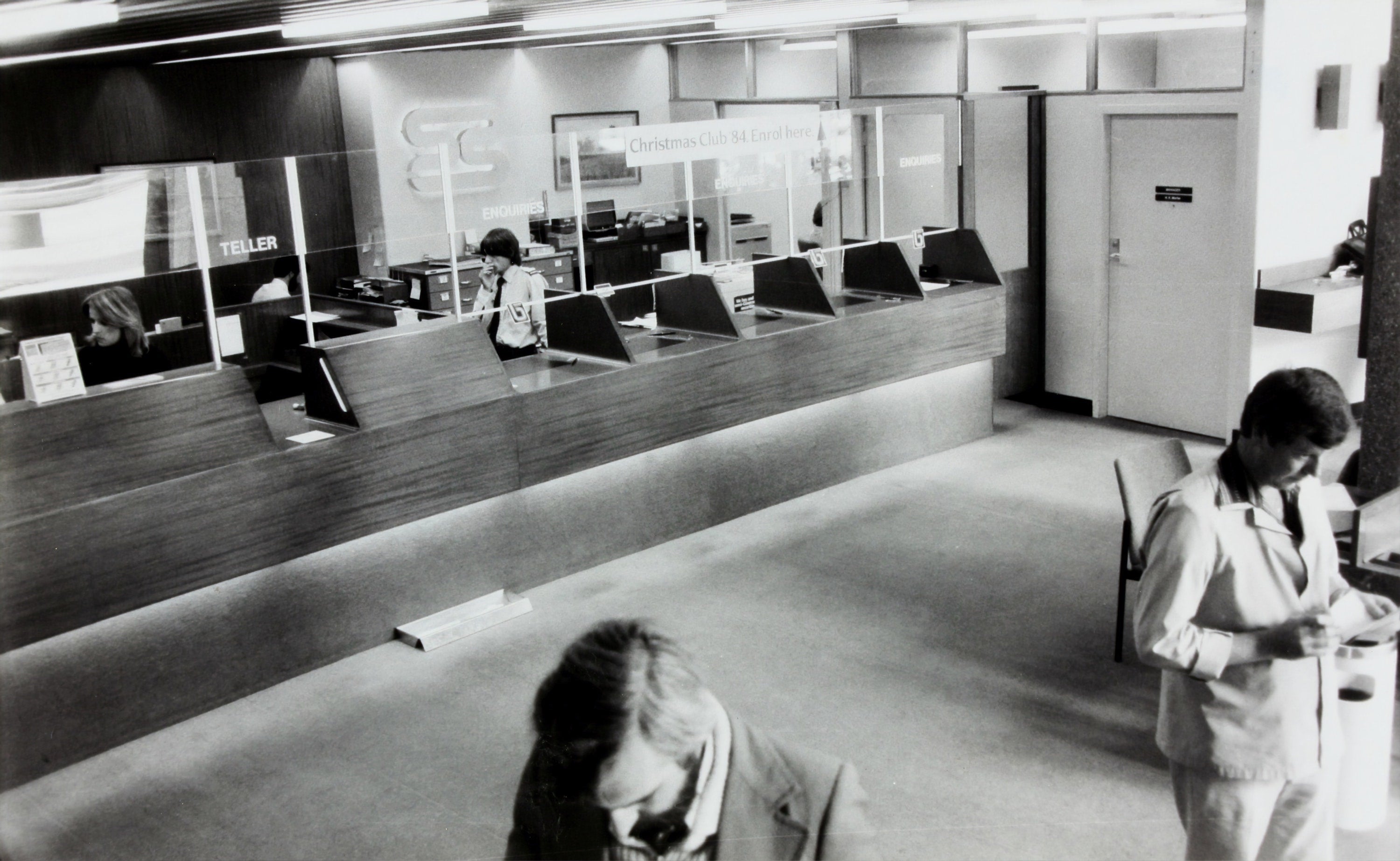

- Optimize your financial infrastructure - The crazy thing about personal finance is most Americans fend for themselves and learn best practices either from their parents, friends, or through trial and error. However, the reality is that there are a set of basic principles that everyone should be following when it comes to personal finance. First and foremost of them is reducing financial complexity amongst credit, debit, and bank accounts. Greater financial simplicity leads to transparency which can serve as a strong foundation to tackle your goals.

- Calculate Breakeven - The reality for most Americans is that month to month spend is highly variable, there is uncertainty on how much to spend, and income can be inconsistent or doesn’t align nicely with when your bills are due. Calculating break-even or knowing how much you can spend relative to your income will set you up to save money and further your financial goals.

- Save $10,000 in cash - Consider this establishing your safety net, This lump sum will allow you to weather most unexpected financial events, plan for vacations, or make larger purchases.

- Invest $100,000 - While going from $10K to $100k can certainly take some time it is incredibly important financially for people to put their money to work through investing. This is an arbitrary benchmark but having six figures relatively early in life can create significant compounded value when we look down the road. We will dive deep into this in future blog posts, as there are a significant amount topics that I would like to cover here.

- Accumulate $1m in net worth - This for many Americans, is the holy grail of making it, achieving millionaire status. The valuable thing about achieving this level of income is that you will be able to claim yourself to be an accredited investor regardless of your income. (Typically being an accredited investor requires a salary of greater than $200k for consecutive years.) In subsequent blogs with the help of a few rough models, we will discuss why this may or may not be a significant milestone for the individual.

- Accumulate $4m in net worth - Using some back of the envelope math, $4m should cover all personal expenses without having to work. Typically people don’t just retire but I can free you up to pursue your own lifestyle choices.

- Accumulate $10m in net worth - Similar to the above, this rough figure should cover all family expenses without having to work. The value of this is, I hope, self explanatory.

- Start a family office $20m - $30m - While I am far from starting a family office, one of the exciting things about family offices is that it gives you access to cheaper capital, which can be a massive accelerator in the growth of anyone’s net worth. In simple, terms the cost of borrowing money becomes significantly cheaper.

- Money is no object ($100M+) - With $100M there is no question that you can live the life you want with access to private yachts, planes, mansions etc. Without having to do very much at all.

Clearly, this is a checklist list that very few people actually make it through. As of 2015 there were 5,000 US households with 100m of wealth or approximately 0.004% of households (assuming a population of 320 million and 2.5 people per household). This doesn’t take into account that many of these households have inherited their wealth, let alone start from zero or less than zero which I and many people do. So the odds are insanely low. If we consider the goal of $1M using the same inputs that turns into 8% of households. A more realistic but still lofty.

I do this math to predominantly squash delusions. The spirit of this blog is to level set expectations on what must be done to achieve these lofty goals over the course of a lifetime. For more information on the first step in this financial journey read on here.

Citations:

1. Beardsley, Brent, et al. “Global Wealth 2015: Winning the Growth Game.” BCG Global, BCG, 16 Apr. 2021, www.bcg.com/publications/2015/financial-institutions-asset-wealth-management-global-wealth-2015-winning-the-growth-game.

2. Fry, Richard. “The Number of People in the Average U.S. Household Is Going up for the First Time in over 160 Years.” Pew Research Center, Pew Research, 1 Oct. 2019, www.pewresearch.org/fact-tank/2019/10/01/the-number-of-people-in-the-average-u-s-household-is-going-up-for-the-first-time-in-over-160-years.

Leave a comment

All comments are moderated before being published.

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.